Executive TLDR

Innovation drives long-term wealth creation through strategic investing.

Franklin Dynatech Fund focuses on companies transforming industries.

Securities licensing unlocks higher compensation and residual income.

Trail income from assets under management builds long-term financial freedom.

2024 is positioned as a reset year for growth conversations with clients.

Video Summary

New Year New Conversations

Jeff Egan opens by encouraging financial professionals to start the year strong with fresh client conversations.

On behalf of Franklin Templeton, he reinforces a simple mission:

Help clients build a better financial tomorrow.

Franklin Templeton emphasizes partnership, accessibility, and support for advisors looking to deepen investment conversations.

The Power Of Innovation Investing

The spotlight turns to the Franklin Dynatech Fund — a strategy dating back to 1968.

The fund focuses on:

Companies driving innovation

Technological disruption

Healthcare advancements

Evolving digital infrastructure

Transformational business models

Innovation is framed as the engine of wealth creation.

From Polaroid cameras to smartphones, from physical retail to Amazon, from video rentals to Netflix, the message is clear:

Every decade produces companies that redefine industries.

The fund’s long-term average return of roughly 11.5 percent since inception highlights how innovation compounds wealth over time.

Using the Rule of 72:

Innovation has the potential to double wealth approximately every six to seven years at that rate.

Expanded Resources Through Acquisition

Jeff also announces the acquisition of Putnam Investments, expanding Franklin Templeton’s tools, strategies, and product solutions.

The goal:

More options.

More flexibility.

More value for clients.

Why Securities Licensing Matters

For non-licensed representatives, Jeff shifts to motivation.

He introduces the “Three C’s”:

Cost. Competition. Compensation.

Cost

Getting licensed today is inexpensive compared to decades past.

Licensing fees are reimbursable after meeting basic production requirements, making the financial barrier minimal.

Competition

Jeff argues that securities-licensed professionals face limited competition:

Traditional wirehouses often ignore smaller accounts.

Banks offer minimal growth solutions.

Primerica’s model allows advisors to serve clients at all asset levels.

Compensation And Residual Income

The strongest case is compensation — specifically trail income.

Assets under management generate:

Ongoing monthly residual payments

Recurring compensation tied to client retention

Scalable income without constant restarting

Jeff compares this to royalty income in music, books, and film — industries where creators get paid repeatedly for work already done.

But unlike entertainment, investment advisory work:

Solves real financial problems

Builds real retirement security

Creates mutual long-term benefit

Buy Term And Invest The Difference

Jeff reinforces the philosophy introduced by Art Williams:

Buy term.

Invest the difference.

To fully execute that philosophy, securities licensing is essential.

Without the ability to invest client assets, advisors limit both impact and income potential.

The Bigger Message

This session blends two core ideas:

Innovation builds wealth.

Licensing builds leverage.

Franklin Templeton positions itself as:

A long-standing investment partner

A $1.7 trillion asset manager

A solution provider focused on outcomes

The closing call to action:

If you didn’t hit your goals last year, reset.

Get licensed.

Have new conversations.

Build residual income.

Invest in innovation.

FAQs

Q: What firm did Jeff Egan represent?

Franklin Templeton.

Q: What fund was highlighted in the presentation?

Franklin Dynatech Fund.

Q: When was the Franklin Dynatech Fund launched?

1968.

Q: What type of companies does the fund focus on?

Innovative, growth-oriented companies across sectors.

Q: What long-term average return was mentioned?

Approximately 11.5 percent since inception.

Q: What is the Rule of 72?

A formula used to estimate how long it takes an investment to double based on its return rate.

Q: What acquisition was announced?

Putnam Investments.

Q: Why is securities licensing important in Primerica?

It allows representatives to invest client assets and earn residual income.

Q: What are the Three C’s mentioned?

Cost, Competition, and Compensation.

Q: What is trail income?

Ongoing compensation earned from managing client assets.

Q: What does AUM stand for?

Assets Under Management.

Q: How does trail income compare to royalties?

Both provide recurring income for work already performed.

Q: What philosophy did Art Williams promote?

Buy term and invest the difference.

Q: Why is innovation central to wealth creation?

Innovative companies often drive long-term market growth.

Q: What is Franklin Templeton’s approximate asset size?

About $1.7 trillion in assets.

Q: What was Jeff’s core message for 2024?

Reset goals, deepen client conversations, and leverage securities licensing for growth.

Glossary

Franklin Dynatech Fund

A growth-oriented mutual fund focused on innovative companies across sectors.

Innovation Investing

An investment approach targeting companies transforming industries through new technologies or business models.

Securities License

Certification allowing financial professionals to sell and manage investment products.

Trail Income

Recurring compensation paid to advisors based on assets they manage.

Assets Under Management AUM

Total market value of client investments overseen by a financial professional or firm.

Rule of 72

A calculation used to estimate how long it takes an investment to double at a given annual return rate.

Residual Income

Ongoing income received after the initial effort or sale has been completed.

Buy Term And Invest The Difference

A financial philosophy encouraging lower-cost life insurance paired with disciplined investing.

Transcript:

Happy new year, everybody. Remember a new year. New, you know, new conversations to have with our clients. This is a great time. And just on behalf of Franklin Temple, just want to say thank you. Thank you for everyone to support us. Thank you for everyone for trusting us with your assets, with your clients assets to do the right thing to help them build a better financial tomorrow. My job is simple today, and hopefully, okay, I’m going to do two things. If you need us, that’s our numbers on the screen. My number, my internal business partner, Al Dothe. Let us know what you need. Let us know how we can help you engage clients in conversations that add better financial value. That’s our job. If you need us, we’re also right down the road in St. Pete.

You can kind of see us, we’re an eyesore building that kind of sticks out like a sore thumb. So just let us know. Stop by, make yourself at home. We definitely want to meet with a lot of people. In the time that I have, I want to cover, hopefully, two things. Number one, for those of you that are securities licensed, talk about a product called Franklin Dynatech Fund, which is more about investing innovation. And number two, for those of you that aren’t securities licensed, if I have the time, tell you why you should get it. You got to walk before you can run. So maybe a little bit about why we should get securities license. But I’m going to jump ahead and really, this is our Franklin Dynatech fund. This is our brochure. Now, I sent these brochures to the church.

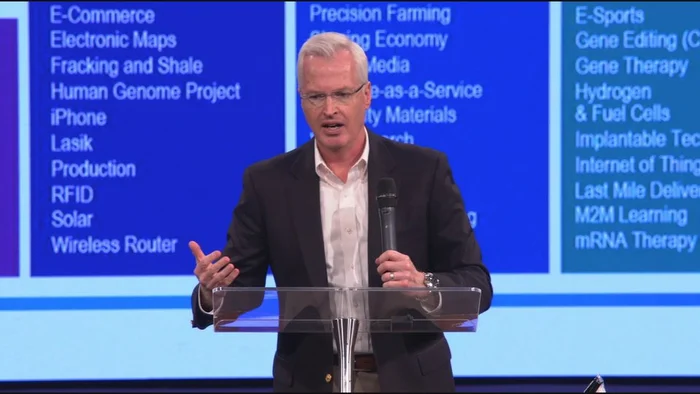

It’s somewhere floating in cyberspace in one of these rooms somewhere. So if you see a brochure later on, or a box that says Franklin Templeton, open up, there’s such good stuff inside, I guarantee it. But I want to jump to my favorite page of the brochure, and that’s this one. Because investing is everywhere and it’s accelerating every year. Innovation is happening right before our very eyes. And see, innovation is transferring how we live. Changing how we live. Now, there’s two forms of innovation. There’s something, there’s creating something new, or there’s making something that exists even better. Now, it’s a little challenging, but I want to kind of go decade upon decade. And the reason why we have so many decades in this brochure is our fund came out in 1968. So every year, every decade, there’s another form of innovation.

I love it in the 1970s when it shows here. One of my favorite forms of innovation are something called instant photos. Do you remember Polaroid, folks? Now for the millennials in the room. Polaroid was a company that you actually took a picture with, not on your phone, but remember those things? Remember before Polaroid came out, how did you get your pictures? You had to drive to a CD parking lot somewhere, right? Drop this thing of film into this slot, and 30 days later, you got your pictures. Innovation. Polaroid came out, clunky machine, but you point, you click, and you shook this thing vigorously for three minutes, but then you got instant gratification. Just think about that. 30 days. Now down to three minutes. Innovation. Fast forward to the were my time. I loved the 80s. Coming home from school, this was me.

And see if anyone can relate to this. Me and my boys walking the streets of Kings Park, Long island, after school, trying to make a difference. Who can relate. 50 pounds of fun. But it played just ten songs. That’s why my posture is the way it is. That’s why I can’t throw a ball. Then what? The Walkman came out. Remember Sony Walkman, where you clip this thing the size of a notebook on your belt, and you walked around town. Definitely not a chick magnet by any stretch of the imagination, but it made music more portable, more flexible. Fast forward. Then there was something called the ipod that created, right? Something the size of a credit card that now didn’t have ten songs, but thousands upon thousands of songs. Innovation. We can keep going.

Remember in the 80s, cell phones came out too, but not the cell phones that we have right now that fit in your pocket. Remember? Anyone ever see the movie Wall street? Remember Gordon Gecko? Greed is good. Yeah. Remember when that one scene where he’s in the limousine and a call comes in and said, what’s that call coming in? He takes this thing out of his jacket the size of a milk carton and answers a call from the car, and everyone was like, damn, no more wires. Innovation. Now fast forward today. Something like Apple. Or if you have a Samsung we still like, people would have Samsung, it’s okay. But now something this size that can do anything that you want it to do. Innovation. All right, then we remember shopping malls, right? What do we have today?

Now we have online shopping companies like Amazon, where any time of the day for $99 a year, Amazon prime. And I should get paid as an endorsement, because every day there’s a box on my front stoop just mocking me. But any day, anything you want is right there. Innovation. Remember we had movies, but even for those millennials in the room, there was a company called blockbuster Video. This is a company for you millennials, where you drove to rent a movie, and as long as you returned it in at least three days, you didn’t get fined. Yeah. Rewind. Be kind. Right now, you have streaming services like Netflix that give you the ability of watching whatever you want, whenever you want. And so God help me, if I want to watch an entire series of a show on a Thursday afternoon, I can do that.

Now. Innovation is everywhere. And then lastly, there’s Google. Not that I want to harp on our millennials, but come on, we have to, because that’s tomorrow’s gen. That’s the future, folks. There was something called Encyclopedia Britannica. I could stop the conversation right now, but I digress. I won’t, folks. Encyclopedia Britannica was everyone’s nightmare, because one day you came home from school and your entire dining room table was now cluttered with this library of your dreams from a to z. And usually they had another one in between there, too. And your parents are like, have at it. And that’s all you can get, anything you want from those things. Now, what do you do? Google. How do I do this? Google. What is this? Google. Help me, Google. Innovation is everywhere. Innovation is accelerating. Our Franklin Dynatech fund is all about that.

Going back since 1968, investing in companies that we believe have the ability to change our lives by making it better through innovation. And it’s not just in technology, it’s in healthcare, it’s in digital currency. Because every decade, every sector is trying to strive for something new. Every decade, every year, companies are trying to better themselves against the competition by bettering us. Well, this is just one of our funds that we have at Franklin Templeton. But the reason why I like to talk about it is one of our fan favorites, because it’s been changing everybody’s lives that have invested in it, because it’s outperformed its benchmark since inception. If we go back since 1968, how many years ago is 1968? A lot. I like that. All the mathematicians in the room, thank you very much for participating.

It’s a lot of years, but it’s average about eleven and a half percent for a lot of years. Do the rule of 72 on that. That means innovation is doubling your family’s wealth. Let us know what we can do. It’s just one of our strategies, and we’re here to help. And we actually just did something great, too. We just acquired Putnam funds over the holiday season, which means you’re going to have more toys, more tools, more resources, more reasons to call your clients and say, how can I help. But like I said, you got to walk before you can run. So for those of you that aren’t yet securities licensed, I’d like to tell you why you should get securities license. If your upline hasn’t done it, please let me do it for you.

And by the time I’m done, please get back with your upline and say, how can I make that happen? Art Williams built this incredible organization, and I’ve been blessed to have worked in some capacity servicing primeric as my client for over 28 years. I left the brokerage side. I was a Smith Barney guy in New York, and I thought that was the world. And then I realized, know, it’s not about tight collars and cufflinks. It’s about retiring with dignity. It’s about showing people financial education and how that changes and improves lives. But one thing that art told us is it’s about buy term and invest the difference. And in order to invest the difference, you got to get securities license. So I want to leave you my three reasons why get securities license. And I call them the three c’s. Cost, competition and compensation.

Save the best for last, of course, let’s talk about cost. Who likes to pay a lot to get something? No, because we’re Americans. We are the greediest people on God’s green earth. If we can get something for nothing, have that. It almost costs you nothing to get securities license today. You have to get licensed, pass the test, do a sale, and they’ll reimburse you the cost. That is amazing. I got licensed in 93. Cost me a couple of wish I had that money to invest instead. Now the only cost to get securities license is to get your fingerprints done. There’s always choice. If you don’t want to pay to get your fingerprints done, you can get your fingerprints done another way. Folks don’t recommend it, but you can. It’s there for you. Get your fingerprints done, take the test, pass the test.

Do what online tells you to do. It’s all on pol. And then start your career in getting people securities license and investing their difference. It’s easy peasy. Number two, competition. There’s two forms of competition in what you do. There’s bankers and there’s brokers. Let’s start off with brokerage, right? Merrill Lynch, Morgan Stanley. Yeah. Who cares about them? If I’m a Merrill lynch advisor today, my commission grid starts at $400,000. Meaning if I talk to someone with less than $400,000, I don’t get paid on that quick show hands. You’re a Merrill lynch advisor. I come to you with 300,000. Are you going to talk to me? Because why you don’t get the joy of primeric is $25 a month, 25 million. And all points in between. You get paid. So get licensed and have a conversation. There’s no competition on the brokerage side.

Let’s talk about the bankers. We love those bankers. Because more money is in bank accounts this year than there was a decade ago. The wall of wealth. There’s $18 trillion sitting in banks right now. Banks don’t give you anything. I remember when I opened up my first saving account. I got something. I got a blender. 15 years of age, and I had a blender. I thought I was the coolest kid on the block. What do you get today when you open up a bank account? You get a lollipop. Another term for a lollipop is a sucker. And the one they give you is a dumb. They’re telling you exactly what they think about you, but they’ll sure as heck take your money. My opinion, we have no competition on the banking side. We have no competition on the brokerage side.

There’s no one in your sandbox. So get licensed and jump in. But now we got to say, what’s in it for me? Compensation. We don’t work for atta boys. Pat on the back. We’re changing others lives. So we should have our lives changed in turn, too. Securities gives you the best form of compensation. My opinion, now I’m biased. That’s my livelihood. So I think everyone should get licensed. Everyone should do as much securities business as possible because you’re helping people. But help yourselves, too. You get licensed, you do a trade, they’ll pay you. You do subsequent trades, they’ll pay you. But my opinion, the best form of compensation, by the way, I just hit puberty.

The best form of compensation, the best form of compensation is something called a trail, a residual, ongoing and forever income stream that remains with you as long as your clients remain with you. It’s a reciprocal relationship. I scratch your back, you scratch mine. I invest your money, I receive compensation for it, called an asset under management. The more assets you manage, the more assets under management you have, the larger this monthly trail payment gets. There’s no better opportunity, no other industry that. I apologize, folks. I wanted to start off 2024. Not lying to anyone. I’m in sales. We tend to mislead on occasion. There is actually three industries that have the same, similar compensation set up as we do in securities. With the trail, it is music, it is books, and it is television and movies.

I still like investing the difference better, but let me just. We’ll talk about this. Let’s talk about music first. Anyone here like music? Going back to that history? I love me some music. I used to be a self proclaimed metalhead. At one point, my hair was down to here. But if I decide to make an album and it sells, and the more time people download it and buy it and go see my shows, I receive royalties on that. And the more times I keep printing this album over and over again, I receive royalties on that. A royalty is a trail. But unfortunately, the last time I checked, jeff Egan’s not going into the studio to drop any funky beats in the foreseeable future, so that’s not going to be happening. So, music off the table. Let’s talk about books.

I write my novel, my thesis, whatever it is, the more issues, every time it goes to print, I get more royalties. I’m not writing the story of Jeff Egan anytime in the near future, so that’s not going to happen now. Television and movies is something that I am aware of because my uncle is in the business. He’s been doing tv and movies for good lord, maybe 50 years now. Started out in New York doing off Broadway, went out to California, and now he’s a movie star. He lives this life, and every time he’s in a movie, he calls me up and says, I’m going to be in this movie. Like, one of his last movies was something called Wolverine, Logan, Wolverine. And I’m a comic book junkie. So is my son, and our favorite character is Wolverine.

And when he told me he was in Logan, my son and I, that’s going to be great. And then recently, he calls and said, guys, I’m probably going to be doing my best movie I ever did. And I honestly think because of COVID and everything, I think this single handedly saved the movie industry. One of his last movies he did was called Top Gun, Maverick, Tom Cruise. It’s not my uncle, but James Handy is. And he pops up in the darndest of places playing different roles, like a bartender, a doctor, this, that, the other, if you are dating yourself. He was on Beverly Hills 9210 and played the mob boss that tried to put the hit on Luke Perry’s character just to date myself a little bit more.

But the idea, he’s been doing this for a half a century, and every time his show or his movie pops up somewhere, USA, TBS, whatever it is, streaming services, he gets a residual check for stuff he did decades ago. But that’s Hollywood, folks. That’s fantasy and that’s make believe. Investing someone’s difference, helping them retire, that’s reality. Helping them put their kids through school, that’s something that we see every day. Getting that dream house, whatever it is. Tony talked about the wants. Everybody has wants, but we can’t afford them. Guess what? If you give people what they want, they’re listening to your music. If you give people what they want, they’re reading your book. If you give people what they want, they’re watching your show, your commercial, your movie. And every month when that happens, you get paid a residual on it.

By giving people what they want, by investing their difference. Whatever we can do at Franklin Templeton to get you to understand the importance of securities license, give us a call. Whatever we can do at Franklin Templeton to help you understand our solution, set our products and services. We’ve been doing this now for close to 80 years. We’re one of the biggest in the industry, about $1.7 trillion of overall wealth. But just simply for one reason. Helping build better outcomes for clients. Well, I have a simple outcome for everyone in here. Get back with the person that invited you here if you are part time, or if you’re just watching this for the first time and figure out how you can get to the next step in your career. But I’d like to end in how I started and wish everyone a happy new year.

Because we get to wipe the slate clean. We have a do over button. Whatever you didn’t do last year, let us know if it comes to the investment side, how we can help you hit those goals this year. On behalf of Franklin Temple and I want to wish you all once again, happy New Year. Great times. See you later on in 2024.