Executive TLDR

Primerica success is built on mastering seven core fundamentals, not shortcuts.

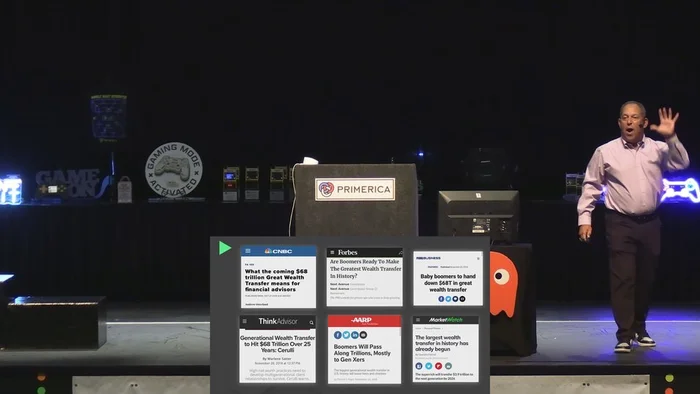

A $68 trillion wealth transfer and advisor shortage create massive opportunity.

Licensing and securities knowledge are critical to long-term growth.

Financial freedom comes from owning a business, not asking for time off.

Prospecting, duplication, and fundamentals create wealth and legacy.

Video Summary

Built On Relationships And Legacy

Jon Lavin shares a 43-year journey that began at age 23 under mentor Dick Walker.

Today:

2,100+ licensed agents

81 Regional Vice Presidents

1st and 2nd generation leadership depth

A business designed to transfer to children and grandchildren

The core message:

This business is not get-rich-quick.

It is get-skilled, get-licensed, get-free.

Why Financial Services Is The Right Industry

Lavin explains two unstoppable economic forces:

The Baby Boomer Wealth Transfer

80 million baby boomers born between 1946–1964

$68 trillion transferring to heirs

10,000 Americans turning 65 daily

This “Wall of Wealth,” first discussed by Bill Arender, creates unprecedented demand for financial guidance.

Advisor Shortage

~300,000 licensed financial advisors

Average age 58

50% retiring within 10 years

Massive money.

Shrinking advisor pool.

Growing consumer confusion.

The opportunity is historic.

Why Licensing Matters

Recruiting without licensing makes no sense.

Lavin emphasizes:

Securities knowledge builds credibility

Investment education attracts serious people

Licensing creates leverage

The goal is not to be a guru —

It is to be skilled enough to recruit others who want to grow.

The Financial House Concept

Primerica builds financial houses in this order:

Foundation — Life Insurance

If income stops, bills don’t. Protection is non-negotiable.

Emergency Fund

Minimum two months liquid. Ideally six months total.

Debt Elimination

Bad debt must be crushed before wealth accelerates.

Wealth Accumulation

Roth IRA, disciplined investing, compounding.

Financial Independence Number

Know exactly how much you need and by when.

Freedom is mathematical — not emotional.

The Seven Fundamentals Of Primerica

Lavin reinforces what leaders like Hector Lamarck have taught for years:

Every rep should grade themselves from 1–10 in these categories:

Prospecting

Appointment Setting

Presenting

Product Knowledge

Overcoming Objections

Recruiting

Fast Start & Duplication

You should aim to be at least a 7 in each category.

Prospecting — The First Skill To Master

Anyone can prospect immediately:

Social media posts

Phone dump lists

Asking for referrals

Leveraging “I’m new and in training”

No expertise required — only activity.

Overcoming Objections

Objections are predictable.

They can be mastered through repetition.

Listen repeatedly to trainings from leaders.

Learn the language like song lyrics.

Eventually it becomes automatic.

Duplication Creates Wealth

The formula is simple:

Identify what people want

Identify what they’re willing to give

Build list

Call list

See list

Stay coachable

Teach others the same cycle

Repeated consistently, this system makes failure impossible.

Freedom Is The Real Goal

Lavin paints a clear picture:

Not loving work —

Loving the results of pouring into people.

Financial independence means:

No asking permission for time off

No denied requests for family moments

Control over schedule

Legacy income

Freedom is earned through fundamentals.

FAQs

Who delivered this message?

The session was delivered by Jon Lavin.

How long has Jon Lavin been in Primerica?

43 years.

What is the “Wall of Wealth”?

A $68 trillion transfer from baby boomers to heirs, first popularized by Bill Arender.

Why is financial services considered the best opportunity?

Massive wealth transfer plus advisor shortages create high demand.

How many financial advisors are in the U.S.?

Approximately 300,000, with many nearing retirement.

What is the foundation of a financial house?

Proper life insurance coverage.

What is a financial independence number?

The amount of money required to live off investments permanently.

Why is licensing emphasized?

It builds credibility, leverage, and long-term income.

What is the first fundamental to master?

Prospecting.

How do you overcome objections?

Repetition, scripts, and consistent training.

What is duplication?

Teaching others to replicate a simple system.

Should every rep own a Roth IRA?

If income-qualified, yes — it is one of the most powerful wealth tools.

Is Primerica a get-rich-quick model?

No. It requires skill development and professionalism.

What creates long-term freedom?

Mastering fundamentals and building leadership depth.

Glossary

Wall of Wealth

The $68 trillion generational wealth transfer from baby boomers to heirs.

Financial Independence Number

The calculated amount needed to retire and live off investments.

Roth IRA

A tax-advantaged retirement account allowing tax-free qualified withdrawals.

Duplication

Replicating a proven business system through others.

Prospecting

Identifying and contacting potential clients or recruits.

Regional Vice President RVP

A leadership contract level overseeing an independent distribution team.

Buy Term And Invest The Difference

A strategy advocating term life insurance combined with disciplined investing.

Master the fundamentals.

License.

Duplicate.

Stay coachable.

And freedom becomes inevitable.

Transcript:

Thank you. Thank you. Thank you, David. Man, what a. This is kind of an emotional night. We built something amazing here. It’s so amazing to see all the new young people coming up in the system and just the awards and the recognition and to see what Charlemagnet and Marlene have built. And Patty and I are just a very blessed couple. You know, I started in this thing. I was 23 in Tampa, Florida. Dick Walker brought me in. And Dick, by the way, is recovering from some surgery and he’s doing well. So just keep Mr. Walker in your prayers. He’s been our mentor and pretty much like a father to me. But that’s the way this business gets built and it gets built with relationships. But I’m going to share with you a little bit.

And by the way, just so you know, you’re hearing that we’re changing things up. You’ll hear all about that tomorrow. It’s going to be big. Okay? I can just tell you, January Twelveth, we’re kicking off a new event with, we’re going to relieve David of his duties of organizing this and doing all the work that he does. So we’ll go into that tomorrow. But it’s going to be amazing. The first one, we’ve got $7 million earners. Mario Arizona and Jimmy Meyer will be guests at that event. And we’re expecting probably 3000 at that kickoff meeting that we’ll be doing over in Tampa. So you’ll get all that information tomorrow. So we’ve got a plan out into the future. Don’t worry. We’re going to keep working together.

We’ve all created something great and we’re going to merge in and do some work with one of the big recruiters in the company, Andy and Brittany onsted. So we’re going to have the privilege of that cross pollinization of getting to learn from each other. And that’s really the magic of what Art Williams built. I was 23 when I started. I didn’t know about all this. If you look at Patty and I today, we’re 43 years in the business. We are blessed with a team of 2100 licensed agents. We’ve got now 81 regional vice presidents. Okay? 13 1st, 26 2nd generation rvps. And when I look at that group, when you look at that group of people that were there, right? You all saw that, right? I override that. I just started out like the rest of you.

I made an appointment and I went out and tried, and then I made a decision to get good at the business. One of the things you need to understand about Primerica is you see so much social media crap now, people are being pounded with opportunities, okay? Quick money, fast money, get rich quick. Do this. It’s all a bunch of crap. You just need to know, this is not that. This is not that. So if you’re new here and you were hoping it was that, sorry, it’s not that. You got to get a license. You got to learn. You’ve got to become a pro. You got to become a pro. You’re not going to make any real money here until you know what you’re doing. You can get started and we’re going to help you a lot.

But at some point we’re going to expect you to know something like, we’re going to be there. We’re going to hold you by the hand, and if you keep showing up and having a great attitude, we’re going to be there for you. But at some point, you need to know something. You need to be able to say something. You need to be able to communicate, right? And so these events are designed to teach you that this is a letter. You all can’t see this, but I’m going to read this to you. I wasn’t going to, but I’m going to because how many of you have a job? How many of you have a job? So you get a paycheck? Okay. Those of you that raised your hand, be honest for a moment. Raise your hand again.

How many of you really are ready not to have a job anymore? Keep your hands up. Okay, so I could say that another way. You’ll get the idea at the end of this letter. It says, dear Jim, I’ve taken the time to review your request for a day off for your child’s birthday celebration. And while I understand the importance of family commitments, we must also remember our obligations to the company and our team. Given the current workload and the pivotal stage we’re at, I regret to inform you that your request has been denied. It’s essential for every team member to be present and contribute to our ongoing projects, especially in these crunch times. I’d like to remind you that we all have personal commitments, but the company’s needs must come first. Moreover, I’ve noted a trend in your recent request for time off.

Let me be perfectly clear. Should you decide to take an unscheduled absence without prior approval, it will be grounds for immediate termination. Your consistent presence is non negotiable. Any deviation from this will not be tolerated. I strongly suggest you reevaluate your priorities and demonstrate a renewed commitment to your role and responsibilities. I expect to see you active on the day in question. Now, I know when I read that, I was, like, repulsed. I don’t know if that’s made up. I don’t know if that’s serious. I don’t know if that’s real. I don’t know if that’s fake. I’m just curious, did any part of that resemble anything that any of you ever deal with in a job? So raise your hand if what I just said kind of touched. You said, yeah, I hate that. Okay. Pretty interesting that we all feel that way, right?

So are you sick and tired of working for other people? So that’s really what Primerica is about. Because at some point, you’ve either got enough money accumulated that you can live and not have to work for other people, or you’ve got a business that can generate income for you, so you don’t have to ever ask for a day off. My favorite part of this business in 43 years is I grew up. I’m a golfer. I love golf. There’s nothing I would rather do than hit a golf ball. That’s what I love. My wife says to a fault, that my priorities are completely out of whack and that golf is first, Primerica is second, and family is third. Now, I argue with her, but I really think family is first, Primerica is second. Obviously, spirituality. Family is second, and golf is third.

But she’s really the boss. And if she says it’s that way, that’s the way. Whatever. She’s. I am a blessed man. She puts up with me, and she cleans up all the mess that I stir up, and I stir up a lot. We would not be where we’re at. We’ve got to wake up every day. I was 23 and she was 19. We’ve gotten to wake up every day together, dreaming about our future together, building a business that’s worth millions and millions of dollars, knowing that will be passed on to our children and to our grandchildren. To know that if anything happened to me or Patty, that our kids are going to inherit. My son’s in the business. My daughter in law, he met her in the business. They know the business.

My daughter’s not in the business yet, but we’re working with the estate planners and all that. The reality is they’re set. So my wish right now is that I could stay healthy enough to really play a lot of golf and to really enjoy my grandkids and to really travel and to really not work very much anymore. How many of you would really like to like, really? That’s what you’d like? All right, so I’m going to stop pretending that I love working. What I love is the results of pouring into people. I love watching people grow and develop. That’s what I love more than anything. I love clients who have accumulated a lot of money and are happy that they met me. I love the result. I love the end result.

But what caused me to do the work here was I had that unique ability and sense that I was at the right place at the right time. And for all of you right now, the way this company is set up, the way the world’s set up, and the needs that the consumer has for us, you are truly at the right place at the right time. Let me just kind of share this with you. I know you all can’t see this, but this says, aside from winning Powerball, the surest route to becoming a multimillionaire in America seems to be working on Wall street and in financial services. The reality is, financial services is where the money is. You need to really understand why. Financial service is very simple now.

There are huge needs for all of the x generation and all the young people that are getting married, having kids, and buying homes. They all need their insurance. But there’s another phenomena that occurred when I started, and that was this whole thing of if you could figure out what the baby boomers needed, you made money. So here’s this story that says what happened between 1946 and 1964. There were 80 million babies born. And so really, any industry or company that could figure out the needs of the baby boomers and provide goods and services that they got rich, they got wealthy. The people that did that got wealthy, the people that built distribution and outlet systems, that got to the masses to serve, they got. So here’s the story. You go back. We can start in 1928. Gerber baby food.

You can’t have a little Gerber baby food there. They sold 70,000 jars of baby food in that year. When it started there in 1928. Well, in 1946, in 1918, years later, from 1946 to 1955, nine years, they sold 1.8 billion jars of baby food. So you got to look out. So then what happened? Then, as the baby boomers aged, as the kids grew up, education, schools, Mattel toys, the toy industry became popular. And then as the kids became teenagers, they wanted fancy cars and the Ford Mustangs started. And then as the baby boomers got older and had kids, they needed. Chrysler needed vans, you needed minivans, right? And so now you look at what do they need? And then the baby boomers got older and started to feel older and wanted to feel young. So they got Harleydavidson motorcycles. Okay, so now what?

So now what? So now you’ve got this situation where there’s $68 trillion that’s getting ready to transfer from the baby boomers parents who are dying and leaving inheritance to baby boomers who have never been educated about money. And the baby boomers are now retiring. There’s 10,000 baby boomers that become age 65 every day, and they tend to get ready to retire, and they pull their money out of the retirement plans. And so you’ve got this huge wall of wealth. It’s so interesting. Bill Arender started talking about this. I know he started talking about this, what, 20 years ago? He called it the wall of wealth. And he told us it’s coming. And when he told me that, I said, okay, I’m going to learn the securities business well enough to recruit people that will want to get licensed in securities.

My whole goal was not to be a securities guru. It was to be good enough where people would want to come in and get licensed. So I knew that the way to get people to want to get licensed is learn the business and earn money at the business and show people how to make money in the investment business. The insurance business was a simple thing to me. Buy term and invest. The difference, it was mathematical. It always made sense. There was no real issues for me on that. I grew up in a base shop operation where there were pros there, certified financial planners, cpas, people that were experts in Dick Walker. And I knew the math behind whole life. Universal life indexed, universal life, infinite banking is just a new remake of it. Iuls are ripoffs just another remake of it.

And it’s not a question, it’s math. There’s no arguing here. There’s a bunch of con artists right now on social media, marketing that crap. So you got the whole insurance industry back at it, selling people the wrong products. So now you don’t have to convince people a lot of times where to find the money. They’re already spending it. And then you got the baby boomers, you got the wall of wealth, then you got the mortgage stuff we started to hear about today. I mean, you couldn’t make this up. Okay, here’s the other thing that’s amazing. When you start looking at the incomes out there. And once again, I’m sorry for this, but there’s 3 million realtors in this country. Are there 3 million homes to sell in this country? There’s 2 million attorneys and 1 million doctors.

And you’ve got only 300,000 financial advisors with securities licenses. And the average age is 58 years old, and 50% of them will be retiring in the next decade. So you got 68 trillion flooding into the market. There’s only 300,000 without people to help them. So are you starting to get the idea? Why are we recruiting? You’re recruiting large numbers of people to find people that want to fall in love with helping people with their money and will get licensed to recruit. A lot of people who don’t get licensed. Makes no sense. Yeah, you can make some sales, but it makes no sense. So we want to start to look at what is it that we really deliver. I mean, we build these financial houses. It’s very simple. Very simple situation. If you want to build any kind of structure, you start with what foundation?

So if you were sleeping in a house tonight, if you went to bed, let’s say, at the hotel, and you found out there was a crack in the foundation of the hotel, how comfortable would you be sleeping in that bed tonight? Well, the foundation of your financial house is your life insurance. If you have people dependent on your income and you die, when you die, what happens to your income generally? What happens unless you’re in primerica? What happens unless you’re in Primerica and you recruited, build and train an army, what happens? It stops and do the bills stop? And so when the income stops but the bills don’t, what happens to the family? Is there a need? There is or there isn’t. You either want to fix that problem or you don’t. We don’t have to do a lot of convincing. Emergency fund.

We need an emergency fund. They say you should have six months of money in an emergency fund. We think at least two months of that should be liquid. We teach that four months of it could be in other places. And if you have two months liquid and you don’t have an emergency, that other money, over time, can start to compound and grow. You can get to a point in life where you can use that emergency fund, becomes a wedding account. It becomes a vacation fund. It becomes something else because you did the right things with the money, and then you’re going to crush your debt. You got to eliminate the bad debt. Right? And then after you get rid of the debt, you want to save and accumulate money and make sure that you hit your financial independence number. Does that make sense, y’all?

So that’s the magic of what we do. And so when you really start to look at it, you have to ask questions to people. Like, simple questions. Do you know your financial independence number? How many of you know your number? Okay, now, if you’re raising your hand right now and you don’t like you, I think I kind of know it, then you don’t know your number. That’s okay. Get your number. Whoever brought you into the business say, I need to know how much money I need to accumulate so that someday I could quit working and live off that money for the rest of my life. And I’d like to have that money at age. And you say the age? And you say, I need this much money at this age. Then we’ll calculate inflation into it.

We’ll show you how to invest an amount every single month and minimum. I’m going to tell you, every one of you should own a Roth IRA. If you’re lucky enough to qualify for a Roth Ira and you don’t own a Roth Ira, you’re probably making the biggest financial mistake of your life. So if you qualify. So some of you, we’re not going to go into what if you qualify for. If you’re under a certain income, you qualify. So now you’re going to build wealth. And here’s the next question. Do you have a debt freedom date? Do you know the date you’re going to be debt free? Here’s another question. Do you have a separate emergency fund? Here’s another question. Do you have the right type of life insurance? Do you have enough life insurance? Do you have a will?

These are all products and services that we offer. When you start to really look at our business and what we do, it comes down to these seven simple fundamentals. You are in for a massive treat because our guest speaker, Joe, the Ward family that’s here, are the best at fundamentals that you’re ever going to meet. Joe Ward is a fundamental genius, and he’s going to hit every one of these in his own way. You just need to know when you look at Primerica and you look at, what do I really need to get good at to start having success once I’m willing to work? And there’s seven fundamentals. I mean, Hector Lamarck titled them the seven Fundamentals. We’ve taught the seven fundamentals. And you all should grade yourself this weekend on your skill set on the seven fundamentals.

Like, if you looked at a test from one to ten and you said, one is, I’m very poor at this fundamental, ten. I’m an expert at this fundamental. You need to have a goal of being a seven or above in every category and you need to grade yourself. So I’m going to ask all of you today, hey, if you’re brand new right now, you may be ones in every category. I could tell you this. If you’re one in every category, you can change the first one quickly. It’s called prospecting. You don’t have to know much of anything to prospect today. You could put a post on your Facebook or ask a friend to put a post on a Facebook that says, my company’s expanding. We’re looking for people who want to make money part time. Let me know if you’re interested. That’s prospecting.

You could build a lead, could dump your phone. So prospecting, everyone could be a ten at today. As a matter of fact, when you’re brand new and you prospect and people ask you questions, you can say, I’m new. I really don’t know the answer. Let’s talk to my manager. I’ll connect you with my manager. They’ll answer all the questions. You get to use that for at least two or three weeks before people start to wonder, what do you mean you don’t know anything? You’ve been there for three weeks. You got to start to know something. But I don’t know. But I need help. I’m in training. Will you help me? That’s prospecting. Appointment setting. You got to know how to set appointments. You got to know how to present.

At some point we even have videos that if you don’t know how to present, you could push a button, it’ll present, we can’t do it for you. Or you can plug people into a meeting that you’re doing that your coaches run for you and they’ll explain it. Then all you have to do after that is have some product knowledge, make sure you’re getting your licenses, learn how to overcome the basic questions or objections they call them. They’re really areas of concerns. I love objections, and there’s only probably about 15 of them. And you could actually learn. You could listen to Hector Lamarck’s audio on overcome. You go to Soundcloud where you can see Jason. He’s probably got it somewhere. He’s got probably a whole library of overcoming objections. Jason, is that fair to say? You have that?

How many overcoming objections training videos or audios do you have? So there’s not an excuse for you not to know how to overcome an objection, right? Because all you have to do is listen to it over and over and over and over and over. Eventually, like the song comes on the radio, and you know the song, you know the words. How many of you have songs that come on, you know every word. How much money are you getting paid to know all those words? Learn some new words, right? And then you learn how to recruit your client, who really, their real problem is they don’t have enough money to reach all their goals. So you recruit them on what we call the shortfall, and then you teach them how to get a fast start, which I’m sure Joe will go into detail on that.

And really getting a fast start in the business is as simple as identifying with what somebody wants. What do you want? Like, the number one thing you should leave here with is what you want. Get clear on what you want. Okay. I wanted a new car. I wanted to move out of my mom’s house, and I wanted to join a country club because I always worked at a country club. That’s how I got good at golf, and I wanted to. Now I live at a country club with three golf courses. That’s in Florida, that country club. I have another. We live at a home on the bay in New Jersey. It’s eight minutes from the golf course. There’s two more golf courses there. I have. Sunday morning, I have a lesson with the top know, like Charlote. You need to learn something.

You just hire someone to do it. Yesterday I had a lesson on short game chipping wedges because I felt like that was the area I needed. Folks, how good would it feel to get up and do what you want, when you want, how you want, where you want, without anyone ever telling you. So figure out what you want, then figure out what you’re willing to give to get it. You got to figure out, what am I willing to give to get what I want. What’s the schedule? Right? Then build a list. Call the list, see the list, stay accountable, stay coachable, and teach people this little cycle, and it’s impossible to fail.

If you have three people, five people, ten people, 20 people, that are all focused on bringing people into the business, finding out what they want, finding out what those people are willing to give, then they’re willing to build a list. Call list, see a list. Implement programs that help people, recruit people who need to make more money or have had a dream of their own business and are tired of working for others and keep teaching people how to do that over and over. Get rich and you get free, and you’re in the right place at the right time with the right company. I appreciate you all. Thank you.