Executive TLDR

Maria Merino delivers a powerful message that the Primerica crusade is still alive because Americans continue to be sold expensive insurance products and flawed financial strategies. She revisits the company’s origins in challenging whole life insurance, critiques universal life and infinite banking, highlights the retirement crisis and lack of financial literacy—especially among Hispanics—and calls on representatives to become committed, mentally tough crusaders who refuse to quit and remain dedicated to helping families win financially.

Video Summary

Maria Merino begins by expressing gratitude to God, leadership, and her teammates, emphasizing how the business allows people from humble beginnings to grow into leaders. She introduces her theme: the crusade is still alive because America still needs Primerica. She revisits the company’s beginnings under its former name A.L. Williams in 1977, when it challenged the insurance industry’s promotion of expensive whole life insurance by introducing the philosophy of buy term and invest the difference. Within seven years, the company grew rapidly and became the largest seller of term life insurance, fueled by representatives passionate about protecting families.

She explains that the industry responded with universal life insurance, promoting it as flexible and innovative. However, when interest rates declined, many consumers received notices that their premiums would dramatically increase, making coverage unaffordable when they needed it most. She also discusses the growing popularity of the infinite banking concept, describing it as a repackaged form of whole life insurance that encourages people to overfund policies and borrow against them. In her view, these strategies often benefit companies more than consumers, proving that the need for crusaders remains.

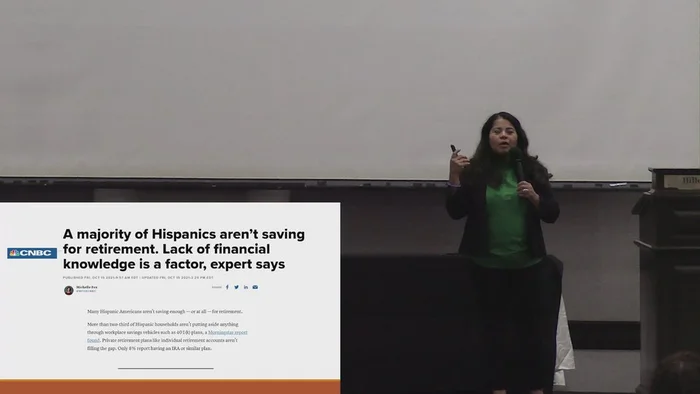

Maria highlights serious financial challenges facing Americans today. Many fear running out of money in retirement, and a significant percentage of older adults are entering their final years unprepared, with little savings and ongoing debt. Among Hispanics, she notes that the primary reason for not saving for retirement is lack of knowledge. She shares a story of helping a woman in her 60s open her first IRA after decades without retirement savings, reinforcing the importance of financial education.

She then shifts to mindset. Success requires commitment, not merely trying the business. She shares an example of an insurance company owner who refuses to hire people who previously left other firms, labeling them quitters. Her point is that longevity and belief in the mission are what create success. Mental toughness is essential because challenges are inevitable, but persistence separates leaders from those who fall away.

Closing with her personal story—from a shy immigrant with no sales experience to a vice president earning substantial income—she reinforces that the opportunity is real. The crusade continues, families still need guidance, and Primerica needs committed individuals willing to stay the course and fight for financial change.

FAQs

What is the Primerica crusade?

It is the mission to challenge traditional insurance practices and promote financial strategies designed to better serve middle-income families.

What does buy term and invest the difference mean?

It means purchasing affordable term life insurance and investing the savings instead of buying more expensive permanent policies.

Why does she criticize universal life and infinite banking?

She argues that these products can become costly and may not serve consumers as effectively as advertised.

Why does she focus on Hispanic communities?

She highlights that lack of financial education is a leading reason many Hispanics are not prepared for retirement.

What mindset does she say is required for success?

Commitment, persistence, mental toughness, and the decision to fully commit rather than just try.

Glossary

Primerica

A financial services company focused on helping middle-income families with insurance and investment solutions.

Buy Term and Invest the Difference

A philosophy of buying term life insurance and investing the cost savings instead of purchasing permanent life insurance.

Whole Life Insurance

A permanent life insurance policy with higher premiums and a cash value component.

Universal Life Insurance

A flexible permanent policy with adjustable premiums and interest-based cash value growth.

Infinite Banking Concept

A strategy that uses overfunded whole life policies as a personal financing system.

IRA (Individual Retirement Account)

A tax-advantaged account designed to help individuals save for retirement.

RVP (Regional Vice President)

A leadership position within Primerica achieved through consistent production and team growth.

Transcript:

Thank you so much. I was about to start dancing some merengue here. Okay first of all I want to thank God for allowing us to wake up this morning and be here. Second, I want to thank Joan Denise Cardino for putting this together. It takes a lot. They don’t have to do it but they do it. Thank you. And third I want to thank my teammates. I love this business because you get to recruit and work with great people and you get to help them and you get to see them develop coming from China’s like me and then develop into great people, great leaders. So I love this business. My talk for today is called the Crusade is still alive. And the subtitle is America needs Primerica. See I want to tell you a story. Back in the days in the insurance industry promoted they were selling whole life insurance which is very expensive insurance that benefit most the company than the consumers, right?

And they could also sell term insurance where they’re promoting whole life. And then Primerica came back in the days former name A. Williams came and started our philosophy by terminate best the difference. And just in seven years of being in business after 1977 Primerica became the number one, the largest term insurance in the whole company and took from 87 people to 120,000 agents that were crusaders that were excited about the crusade of fighting their own against the insurance industry. Selling expensive policies that doesn’t benefit the consumers, right? So back then Primerica step out. They were the crusaders. But guess what then in the industry figured out a way to promote a new policy, universal Life. And back then it was very popular. It was sensational. It was like the best flexible premiums, two different interest rates. It was sold a lot. But these policies in my opinion are worse than Whole Life because after the consumers, after paying a lot of money into these policies and years later when the interest rates declined, the consumers got letters saying the insurance premiums were going to go up from like let’s say fifty dollars to two hundred and fifty dollars.

Consumers were not able to afford to keep those policies in for when they needed the most. Right? So that was justice again that the insurance industry was doing against consumers. So we need the Crusaders still alive. People still need our help. America still needs Primerica, right? And now who has heard of this concept? Infinite banking. Right? The insurance again was created to come out with something different, a different way to suit Whole Life. Basically this is Whole Life and guess what? People are buying it. That buy expensive whole life insurance, put a lot of money into that and then borrow, if you need a car loan, borrow from the insurance company instead of going to the bank. Be your own bank. Pay the lower interest in the policy back to you instead of the bank. And guess what? People are buying it. So the crusaders still alive?

We need crusaders. We need to go out there and let people know that is wrong, right? What’s our philosophy by terminate invest the difference by terminal? Best of difference was is and it always be the right thing for most people. The right is triers, right? So we need more crusaders. And I know I’m talking to the crusaders, right? We need more crusaders. America needs Primerica. And how about this? The number one or the most number one reason why Latinos, Hispanics I’m Hispanic, right, are not saving for retirement is because lack of knowledge. So there’s a lot of people I meet people all the time. Maria. I’ve been just not too long ago, I help a lady open, IRA. She’s in her 60s. She doesn’t look like but she’s in her 60s for 20 years working for herself. Not able to fund any retirement. Looking for someone to help her.

Could never find anybody until someone referred her to me. So in her 60s, she started saving for retirement. So lack of knowledge. So we need more crusaders. America needs Primerica how about more than 60% of Americans are worried that they won’t have enough money. They will run out of money every time. Why? Because they were sold the wrong kind of investments, the wrong kind of insurance, the wrong strategy. So we need more crusaders. The crusaders still alive. People still need what we do, right? And guess what? This tells everything. This was taken out by the Wall Street Journal. The people who are facing who are going the elders right now are unprepared. They’re facing the last decade of life unprepared. No savings, little income, debt, and failed by the insurance companies. So we need more crusaders. America needs Primerica. And guess what? Primerica needs you.

Primerica needs us to become a crusader. To be like back in the days, those people who didn’t have everything we have, but they were excited about going out there and helping families. Going against the giants, the insurance company with no name. And they became the number one. Why can’t we do that right now? People still need what we do. We can do it right. Have a be passionate. Passionate about helping families, doing what we know what to do. The right thing, right? How about making a decision that this is not something you’re trying? I see a lot of people. Let me try it. No. Make the decision this is not something you’re trying. This is something you’re doing. It’s a difference, right? I was looking at an interview by this guy who has an insurance, owns an insurance company. He was saying that when he interviews agents, people that want to become agents, when they start telling, he asked, Where have you worked?

And they said, I work for New York. I work for Medlife. I work for Edward Jones. And he’s like, I’m not hiring you. They’re like, Why? I have experience. No, you don’t have experience. You are quitter because you quit New York. You quit medlive. You’re a quitter. You’re going to quit my company too. No. Right? And I was like, that makes a lot of sense. That’s true. You see, the people are here. You heard how long they’ve been here. That’s why they’re successful. They’re not quitters. They stick around. They believe in what they’re doing. The company, the crusade, and they keep moving it out to the giants. Right? So how about becoming committed? People think that being committed is just I’m serious about doing Primerica. Really? When something hits you, do you quit? Do you change? Do you say, oh, maybe this is not for me, or you stay persistent and you stay committed.

You got to be committed, right. Mentally tough. Like a couple of you have said, life is going to hit you whether we like it or not. But it’s up to us to continue the journey, to continue fighting for our dreams. And it’s not easy, but it’s doable. And we have many examples here. All the vice presidents, I admire you so much. Every one of you have a great story. You encourage us and we keep moving because we know that there’s a lot of people that we’re going to impact. We literally change lives in every way. Right? I love recruiting because you get someone like me, I was so shy, no experience. I come from a different country and speaking the English, no sales experience, nothing. And today I’m a vice president. Right. Thank you. Last month, we traveled to Mexico for a week and we make like $8,600, almost 10,000 travel, taking it easy.

I’m like, where can I go where I can make like Joe Cardino? Half a million dollars only in Primerica. And a million dollars and two and three. Right. Sky the limit. So thank you so much.